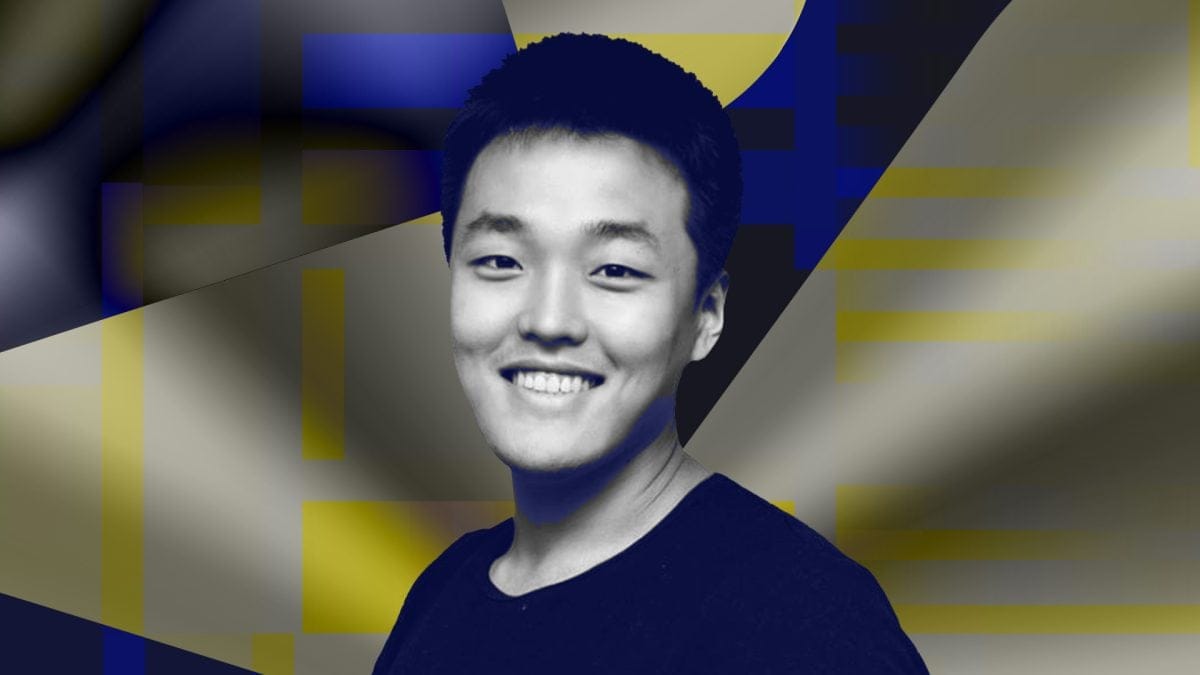

US prosecutors push for 12-year prison sentence for Terraform co-founder Do Kwon's role in $40 billion collapse

Quick Take

- Prosecutors say Kwon’s previous misconduct and the sheer size of the fraud are among the reasons for the 12-year prison sentence.

- Kwon’s lawyers have argued that a prison term of up to five years was sufficient.

U.S. prosecutors say Terraform Labs founder Do Kwon should get 12 years in prison for his role in the remarkable $40 billion collapse of the Terra and Luna tokens.

In a sentencing submission filed on Thursday to the U.S. District Judge Paul Engelmayer for the Southern District of New York, prosecutors say Kwon's previous misconduct and the sheer size of the fraud are among the reasons for the 12-year prison sentence.

"The sheer scale and impact of Kwon's yearslong fraud is notable," they said in the filing. "Kwon deprived UST and Terra purchasers of the ability to make fully informed decisions about their purchases, and artificially inflated the value of Terraform's cryptocurrencies, which directly enriched and raised Kwon's profile."

Last week, Kwon's lawyers argued that a prison term of up to five years was sufficient, citing that the crash was partly due to coordinated trades by third-party firms exploiting vulnerabilities, citing academic papers and reports from Chainalysis.

Kwon was criminally charged in March 2023 with conspiracy to commit fraud, commodities fraud, wire fraud, securities fraud, conspiracy to commit fraud, and engaging in a conspiracy to commit market manipulation and money laundering. He later pleaded guilty in August to wire fraud and conspiracy to defraud.

The charges were tied to the crumbling of Terra USD — an algorithmic stablecoin that uses market incentives via algorithms to maintain a stable price. Terra was linked to Luna, a governance token, to keep the prices stable. Terra USD's disintegration provoked a contagion event that brought down several crypto entities in 2022. Prosecutors say Kwon lied about the risks and stability associated with the tokens.

On Thursday, prosecutors said Kwon should forfeit a little over 19 million dollars, adding that they would not be seeking restitution.

"The cost and time associated with calculating each investor-victim’s loss, determining whether the victim has already been compensated through the pending bankruptcy, and then paying out a percentage of the victim’s losses, will delay payment and diminish the amount of money ultimately paid to victims," they said.

Kwon's legal proceedings have been tumultuous. He was arrested in Montenegro in March 2023 for traveling with forged travel documents. At the time, both the U.S. and South Korea had issued warrants for his arrest, which led to a back-and-forth over where he would eventually be extradited. Eventually, he was extradited to the U.S. in December 2024.

Kwon also faced civil charges in a case brought by the Securities and Exchange Commission in February 2023. The trial for Terraform against the SEC started last year, though without Kwon.

In April 2024, a jury found that both Terraform and Kwon misled investors and were found liable for civil fraud.

The sentencing submission was signed by U.S. Attorney for the Southern District of New York Jay Clayton. Clayton previously served as chair of the SEC under the first Trump administration and was tapped in November 2024 for his U.S. attorney position.

Kwon's sentencing date is set for Dec. 11.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.